Indexnasdaq: .ixic Charts, Data & News

Understanding the Indexnasdaq: .ixic

Nasdaq Stands for the “National Association of security Dealers Automated Quotations.”

An Introduction to the Nasdaq Composite Index

In 1971, the Nasdaq Composite File, now and then known as the Nasdaq, was made. It Comprises of hundreds of tech-focused business hat are recorded on the Nasdaq stock showcase. The file is respected for being innovative and energetic, highlighting both built p innovation businesses and up-and Coming new Companies. Both Budgetary specialists and financial specialists must comprehend its structure.

Key Components of the Nasdaq Composite Index

The Nasdaq Composite Record is composed of companies from different Segments, Counting innovation, Healthcare, Shopper Administrations, and more. The different composition separates it from other lists just like the Dow Jones or S7P 500 Which focus on specific businesses. Speculators have to be got a handle on the centrality of these components and their Weightings inside the file to create educated venture choices.

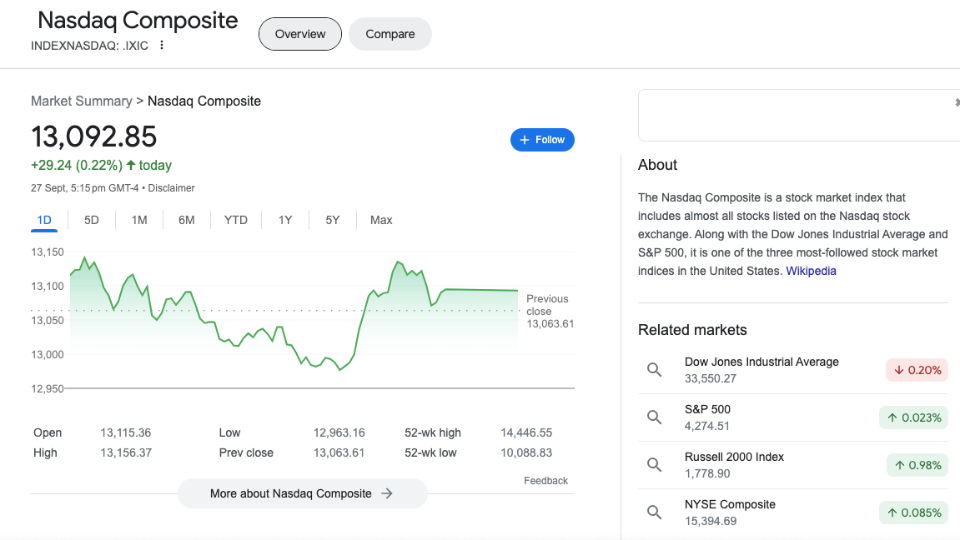

| Indexnasdaq: .ixic Market Closed13,092.85 |

Historical Performance of the Nasdaq Composite Index

An audit of the Nasdaq Composite’s authentic execution uncovers a rollercoaster ride. It experienced brilliant rises amid the dot-com bubble of the late 1990s, taken after by an emotional crash. However, it illustrated strength, in the long run recouping and coming to unused statures. Understanding the history of Nasdaq can give you profitable experience into showcase pattern and offer assistance financial specialists explore the ever-changing scene of Nasdaq Composite File.

NASDAQ Composite Index

Overview

| Performance | 5 Day | 1 Month | 3 Month | YTD | 1 Year |

| Change | -0.99% | -6.71% | -3.67% | 25.09% | 21.94% |

PERFORMANCE

| Key Data | OPEN | DAY RANGE | 52 WEEK RANGE |

| Value | 13,115.36 | 12,963.16 – 13,156.37 | 10,088.83 – 14,446.55 |

Top PERFORMANCE

| NAME | LAST | CHG | CHG % |

| ShiftPixy Inc. | $1.05 | 0.62 | 141.38% |

| MSP Recovery Inc. | $0.22 | 0.07 | 46.35% |

| SciSparc Ltd. | $0.21 | 0.05 | 32.86% |

| MillerKnoll Inc. | $24.51 | 5.36 | 27.99% |

| Wheeler Real Estate Investment Trust Inc. | $3.54 | 0.67 | 23.34% |

| Mobile Global Esports Inc. | $0.36 | 0.07 | 22.86% |

| Theratechnologies Inc. | $2.15 | 0.4 | 22.86% |

| Galecto Inc. | $0.70 | 0.13 | 22.24% |

| Alzamend Neuro Inc. | $0.23 | 0.04 | 21.99% |

| Phoenix Motor Inc. | $0.69 | 0.12 | 20.35% |

Bottom PERFORMANCE

| NAME | LAST | CHG | CHG % |

| Faraday Future Intelligent Electric Inc. | $1.37 | -1.09 | -44.31% |

| mCloud Technologies Corp. | $0.18 | -0.12 | -40.24% |

| Jaguar Global Growth Corp. I Cl A | $5.30 | -3.09 | -36.83% |

| Minerva Surgical Inc. | $0.18 | -0.1 | -36.28% |

| Anzu Special Acquisition Corp. I Cl A | $6.50 | -3.52 | -35.13% |

| Tharimmune Inc. | $0.20 | -0.09 | -31.68% |

| Sharps Technology Inc. | $0.57 | -0.25 | -30.40% |

| Rallybio Holdings LLC | $3.52 | -1.43 | -28.89% |

| FLJ Group Ltd. ADR | $0.16 | -0.07 | -28.70% |

| Cheche Group Inc. | $12.00 | -4.12 | -25.56% |

Indexnasdaq: .ixic: A Market Benchmark

The Nasdaq Composite index is an important tool for fund managers, financial leaders and government policy makers that provides better information about market, economic and financial trends.

Why the Nasdaq Composite Index Matters

Agreeing to my Conclusion, the indexnasdaq: .ixic Record may be an exceptionally critical apparatus in fund. it is like a measuring adhere that makes a difference people groups to get it how businesses are working and developing, particularly which are based on innovation and the web. It’s not fair for checking the advertise and commerce; it tells us around modern thoughts, advance, Benefits, and how the economy is changing. Speculators, specialists and who consider cash, and government decision-makers pay a part of consideration to it since it gives us a enormous picture of what’s happening in today’s businesses and the cash world.

Comparing the Nasdaq Composite to Other Indices

Comparative investigation between the Nasdaq Composite Record and other major records, such as the Dow Jones Mechanical Normal and the S&P 500, yields fundamental bits of knowledge for speculators. Whereas the Dow Jones speaks to a smaller determination of 30 set up companies, and the S&P 500 comprises a broader cross-section of 500 huge U.S. firms, the Nasdaq Composite casts a wide net. Its consideration of different segments, counting innovation, healthcare, and buyer administrations, gives financial specialists with presentation to diverse businesses and chance profiles. This difference permits speculators to tailor their portfolios to explore different showcase conditions viably.

Tracking Market Trends with the Nasdaq Composite Index

Taking after exhibit designs utilizing the indexnasdaq: .ixic List goes past unadulterated data investigation. This may be a apparatus that helps monetary specialists and reviewers in getting a handle on the ever-evolving money related environment. In extension to being a pointer of budgetary presumption, the record in addition a marker of around the world monetary presumption. It allows us information in progression of development, proficient and changing customer behavior. In this way, taking after the Nasdaq Composite List can grant an important result for choosing the complexity of today’s budgetary circumstance and making wander choices.

Investing in the Indexnasdaq: .ixic

Contributing in technology-driven companies presents openings for development potential, but moreover presents chance. The Nasdaq Composite Record, centering on tech monsters like Apple, Amazon, and Microsoft, offers assorted speculation openings and hazard variables.

Investment Opportunities in the Nasdaq Composite Index

The Nasdaq Composite List is domestic to over 3,000 companies, crossing different businesses, but with a specific accentuation on innovation, healthcare, and customer optional segments. This different quality present speculators with an interesting opportunity to pick up presentation to a wide imaginative and growth-oriented businesses. Companies recorded on the Nasdaq frequently display higher development potential compared to those on other major records just like the S&P 500, which comprises a broader cross-section of businesses. Speculators can advantage from the potential for capital appreciation and profits, as numerous Nasdaq-listed companies reinvest their benefits for development.

ETFs and Funds Linked to the Nasdaq Composite Index

Contributing within the Nasdaq Composite Record can be accomplished through a assortment of monetary disobedient, counting Exchange-Traded Stores (ETFs) and shared reserves that track the index’s execution. Outstanding choices incorporate the Invesco QQQ Believe (QQQ) and the ProShares UltraPro QQQ (TQQQ), which offer presentation to the beat 100 non-financial companies on the Nasdaq. These venture vehicles give speculators with a helpful and differentiated way to get to the Nasdaq Composite List, making it appropriate for both amateur and experienced financial specialists.

Risk Factors Associated with Nasdaq Composite Index Investments

Whereas the indexnasdaq: .ixic File offers significant development potential, it’s basic to be mindful of the related risks:

Volatility: Innovation stocks are known for their cost instability. Financial specialists ought to be arranged for critical cost vacillations, which can be both an opportunity and a risk.

Concentration: The Nasdaq Composite Record is intensely weighted towards the innovation division. A downturn in tech can have a significant effect on the index’s performance.

Interest Rate Affectability: Tech stocks are touchy to changes in intrigued rates. Rising rates can lead to lower valuations for high-growth companies.

Regulatory Hazard: Government controls and antitrust activities can influence the commerce operations of tech companies, affecting their stock costs and, subsequently, the index’s performance.

Currency Chance: Numerous companies within the Nasdaq Composite List have worldwide operations, uncovering speculators to cash fluctuations.

Lack of Profits: A few tech companies reinvest benefits instead of paying profits, potentially limiting pay era for investors.

In conclusion, contributing within the Nasdaq Composite File offers openings for speculators to advantage from development and development. In any case, it’s basic to survey dangers and consider differentiating speculation portfolios.

Tech Stocks and the Indexnasdaq: .ixic

The Nasdaq Composite Record, recognized for its energetic representation of tech mammoths like Apple, Amazon, Microsoft, and Letter set, serves as an pointer of their execution. I think the good thing about progression is highlighted by the nearness of tech giants within the market, so it’ll emphasizing the significance of Nasdaq within the way of speculations. Mammoth Vitality Administrations, Inc. could be a common stock recorded on indexnasdaq: .ixic.

Tech Titans Driving the Nasdaq Composite Index

The Nasdaq Composite Record owes much of its triumph to the energetic progress and advancement of tech titans.These companies are at the passing on edge of mechanical headways, pushing boundaries in AI, cloud computing, e-commerce, and more.Apple’s groundbreaking things, Amazon’s e-commerce space, Microsoft’s cloud computing dominance, and Google’s see motor capacity proceed to fuel the index’s rising. Their influence heighten past standard tech, affecting parcels like healthcare, back, and transportation, making them in a common sense players in around the world markets.

Innovation and Growth in the Nasdaq Composite

Development is the soul of the Nasdaq Composite List. The index’s composition incorporates not as it were set up tech mammoths but too a assorted run of inventive new businesses. This blend cultivates a energetic biological system that always pushes the boundaries of innovation and disturbance. From electric vehicle producers to biotech trend-setters, the Nasdaq grasps companies that rethink businesses and make considerable development openings for speculators looking for introduction to the cutting edge of development

Challenges in Tech Investing with the Nasdaq Composite Index

In appear hate toward of its inquire, contributing interior the indexnasdaq: .ixic List presents one of a kind challenges. The tech sector’s common frailty can lead to crucial gotten dangers, requiring scholars to have a solid stomach for publicize swings. Also, concerns about definitive examination, antitrust works out, and security issues have included a layer of defenselessness. Broadening over divisions and hazard organization strategies are basic for examining the potential pitfalls of tech contributing.In appear hate toward of its offer, contributing interior the Nasdaq Composite Record presents exceptional challenges. The tech sector’s common flimsiness can lead to principal taken a toll changes, requiring researchers to have a strong stomach for appear off swings. Other than, concerns around authoritative examination, antitrust works out, and security issues have included a layer of powerlessness. Broadening over parcels and peril organization methodologies are principal for exploring the potential pitfalls of tech contributing.

Nasdaq Composite Index Analysis

Analyzing the Nasdaq Composite File includes a multifaceted approach that envelops advertise instability appraisal, specialized investigation, and thought of crucial variables.

Analyzing Market Volatility through the Nasdaq Composite

The Nasdaq Composite Record may be a prime pointer of grandstand precariousness, particularly inside the advancement division. This index’s components consolidate a expansive number of tech companies, which are known for their fetched precariousness. When analyzing showcase instability through the Nasdaq Composite, speculators and investigators closely observe for sharp cost swings, as they regularly flag shifts in speculator assumption and chance craving. Components like financial information discharges, geopolitical occasions, and changes in intrigued rates can trigger instability inside the record. Analyzing these variances gives important bits of knowledge into broader advertise patterns and the opinion encompassing tech stocks, making a difference financial specialists make educated choices.

Technical Analysis of Nasdaq Composite Index

Specialized examination of the Nasdaq Composite incorporates scrutinizing chronicled fetched data, trading volumes, and chart plans to recognize potential future taken a toll improvement. Merchants and examiners utilize distinctive specialized pointers, such as moving midpoints, Relative Quality Record (RSI), and Bollinger Bunches, to assess the index’s drive and potential area or exit centers. Specialized examination can offer basic short-term bits of data into the index’s behavior and offer help dealers in making crucial choices. In any case, it’s fundamental to complement specialized examination with a fundamental understanding of the essential companies to create a comprehensive see of the publicize.

Fundamental Factors Affecting the Nasdaq Composite Index

The Nasdaq Composite Index’s execution isn’t exclusively decided by specialized markers; crucial variables play a pivotal role. Financial specialists ought to consider principal perspectives such as profit reports, income development, and valuations of the person companies inside the file. High-growth tech companies frequently reinvest benefits for extension, making profit and income development basic. Besides, macroeconomic components like intrigued rates, expansion, and government arrangements can impact the index’s heading. In later a long time, administrative changes and geopolitical pressures have too developed as noteworthy components affecting tech stocks and, subsequently, the Nasdaq Composite.

Global Impact of the Nasdaq Composite Index

The Nasdaq Composite Record, essentially known for its representation of the U.S. innovation segment, amplifies its impact well past American borders. It serves as a universal marker of showcase estimation and innovative development.

Nasdaq Composite Index as an International Indicator

The Nasdaq Composite Record may be a broadly recognized benchmark for around the world examiners. Its overpowering weighting towards advancement and improvement companies reflects designs that rise over national boundaries. Worldwide speculators regularly utilize the Nasdaq as a gage of the wellbeing of the technology sector and the in general hazard craving within the worldwide markets. As a result, when the Nasdaq performs well, it can draw in worldwide capital, driving up its esteem.

How Global Events Affect the Nasdaq Composite

Worldwide occasions have a critical affect on the Nasdaq Composite Record. Changes within the worldwide economy, political circumstances, and discretionary relations can impact the execution of the tech companies inside the file. For occasion, exchange pressures or administrative activities including worldwide tech monsters can lead to instability within the Nasdaq Composite. In addition, worldwide financial emergencies can influence the request for innovation items and administrations, in this way influencing the profit of Nasdaq-listed companies and, in turn, the index’s execution.

Nasdaq Composite Index and the Global Economy

The Nasdaq Composite’s execution is closely interwoven with the worldwide economy. Its components consolidate multinational organizations with distinctive salary streams around the world.As such, financial patterns, cash variances, and geopolitical occasions can affect both person companies and the file as a entirety. Financial specialists and investigators around the world track the Nasdaq Composite as an pointer of worldwide financial wellbeing and the tech industry’s strength.

Trading Strategies with the Nasdaq Composite Index

Contributing within the Nasdaq Composite File offers different exchanging techniques to suit distinctive chance cravings and timeframes. Here are a few key approaches:

Day Trading with the Nasdaq Composite Index

Day exchanging the Nasdaq Composite includes executing short-term exchanges inside a single exchanging day to benefit from intraday cost vacillations. Dealers center on specialized examination, closely observing charts and utilizing markers to distinguish passage and exit focuses. Due to the tech-heavy composition of the record, day exchanging can be especially energizing and unstable, giving openings for fast picks up. It’s fundamental for day dealers to remain educated almost showcase news and occasions that can affect tech stocks and the index’s by and large course.

Swing Trading Strategies for Nasdaq Composite Stocks

Swing dealers point to capture cost swings over a period of a few days to weeks. They utilize specialized and, in some cases, principal examination to distinguish potential passage and exit focuses. Swing exchanging suits those who lean toward a less seriously exchanging fashion compared to day exchanging. Compelling chance administration and setting clear stop-loss levels are significant in this approach, given the potential for showcase instability.

Options and Futures Trading on the Nasdaq Composite Index

Alternatives and prospects give progressed exchanging methodologies for Nasdaq Composite presentation. Financial specialists can utilize alternatives to support their portfolios or guess on future file developments. Prospects contracts permit for utilized positions, intensifying both picks up and misfortunes. Remaining upgraded on the most recent alternatives and prospects exchanging patterns, as well as understanding the inferred instability of the Nasdaq Composite, is basic for those wandering into subsidiaries exchanging.

Indexnasdaq: .ixic and the Digital Age

Within the computerized age, the Nasdaq Composite File has ended up synonymous with mechanical advancement and change. Here’s a see of its part in this time:

Digital Transformation Companies in the Nasdaq Composite

The Nasdaq Composite Record is domestic to a huge number of companies driving the charge in computerized change. Tech monsters like Apple, Amazon, and Microsoft, in conjunction with troublesome trailblazers such as Tesla and Zoom Video Communications, are all recorded on the Nasdaq. These enterprises move progressions in cloud computing, online commerce, electric vehicles, and different collaborative gadgets, on a very basic level changing businesses on a worldwide scale.

Cryptocurrency and the Nasdaq Composite Index

Whereas not straightforwardly tied to cryptocurrencies, the Nasdaq Composite reflects the broader affect of computerized monetary standards on budgetary markets. As cryptocurrencies picked up noticeable quality, speculator intrigued in blockchain innovation surged. Nasdaq itself has investigated blockchain applications in money related administrations. Furthermore, crypto-related companies like Coinbase and MicroStrategy are recorded on the Nasdaq, illustrating the index’s pertinence within the advancing crypto scene.

Nasdaq Composite’s Role in the Fintech Revolution

The Nasdaq Composite plays a urgent part within the fintech insurgency by giving a stage for fintech companies to get to capital markets. Fintech firms like Square, PayPal, and Adyen are recorded on the Nasdaq, leveraging its perceivability and liquidity to fuel their development. Other than, the Nasdaq’s development and authority have been instrumental in advancing fintech system, supporting computerized installments, online overseeing an account, and wander stages.

MAJOR STOCK INDEXES

| KEY U.S. | LAST | CHG | CHG % |

| Dow Jones Industrial Average | 33,550.27 | -68.61 | -0.20% |

| NASDAQ Composite Index | 13,092.85 | 29.24 | 0.22% |

| S&P 500 Index | 4,274.51 | 0.98 | 0.02% |

| Russell 2000 Index | 1,778.90 | 17.29 | 0.98% |

| OTHER U.S. | LAST | CHG | CHG % |

| Dow Jones Transportation Average | 14,827.74 | 8.51 | 0.06% |

| Dow Jones Utility Average Index | 832.13 | -12.71 | -1.50% |

| Dow Jones U.S. Total Stock Market Index | 42,625.58 | 62.01 | 0.15% |

| NASDAQ 100 Index (NASDAQ Calculation) | 14,580.16 | 34.33 | 0.24% |

| S&P 400 Mid Cap Index | 2,485.04 | 13.95 | 0.56% |

| NYSE Composite Index | 15,394.69 | 13.11 | 0.09% |

| Barron’s 400 Index | 959.39 | 8.35 | 0.88% |

| CBOE Volatility Index | 18.05 | -0.17 | -0.93% |

| GLOBAL | LAST | CHG | CHG % |

| Global Dow Realtime USD | 3,972.10 | -7.51 | -0.19% |

| ASIA/PACIFIC | LAST | CHG | CHG % |

| The Asia Dow Index USD | 3,325.86 | -39.75 | -1.18% |

| S&P/ASX 200 Benchmark Index | 7,024.80 | -5.5 | -0.08% |

| Shanghai Composite Index | 3,110.48 | 3.16 | 0.10% |

| Hang Seng Index | 17,363.76 | -248.11 | -1.41% |

| S&P BSE Sensex Index | 65,680.28 | -438.41 | -0.66% |

| NIKKEI 225 Index | 31,872.52 | -499.38 | -1.54% |

| FTSE Straits Times Index | 3,203.27 | 3.24 | 0.10% |

| EUROPE | LAST | CHG | CHG % |

| STOXX Europe 50 Index | 3,907.09 | 6.34 | 0.16% |

| STOXX Europe 600 Index | 447.2 | 0.29 | 0.06% |

| CAC 40 Index | 7,092.60 | 20.81 | 0.29% |

| DAX | 15,239.00 | 21.55 | 0.14% |

| IBEX 35 Index | 9,365.90 | 34 | 0.36% |

| FTSE 100 Index | 7,580.27 | -12.95 | -0.17% |

| AMERICAS | LAST | CHG | CHG % |

| BOVESPA Index | 114,327.05 | 133.62 | 0.12% |

| S&P/TSX Composite Index | 19,435.98 | -120.17 | -0.61% |

| IPC Indice de Precios Y Cotizaciones | 51,427.27 | 319.47 | 0.63% |